More interested in watching your Market Update?

Unlocking Wealth and Housing Options in Calgary's Soaring Real Estate Market

Calgary's real estate market has been setting new records, making headlines for its impressive growth. It's no secret that Calgary continues to thrive as a hot seller's market. However, beyond the headlines, there's a lot more to explore, from the booming rental sector to the age-old question of whether to rent or buy. In this Calgary Real Estate Market Update, we'll dive deeper into these facets and provide you with essential insights to help you make informed decisions.

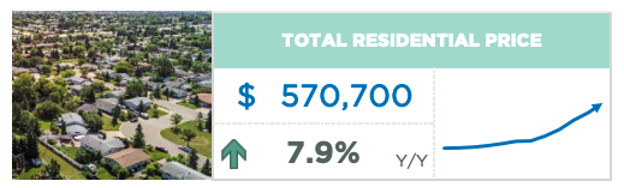

In August alone, we witnessed a remarkable 7.4% increase in property prices compared to the previous year, with total sales surging by nearly 28%. These figures mirror the robust growth we observed in July, with approximately 2,600 homes changing hands.

Diving into the specifics, detached homes have shattered the $700,000 barrier, boasting an average price of $709,000, signifying an impressive 11% increase from the previous year and a substantial $120,000 jump from August 2021.

Semi-detached properties have experienced a parallel 11% growth, now averaging $580,000, a price point similar to detached homes two years ago. The row townhouse market is not lagging either, with a remarkable 22% surge, outpacing the freehold segments and resting at $419,000. This trend is likely influenced by the bustling activity within the condo/apartment segment, which has also witnessed double-digit gains, up by 15% from the previous year.

This is likely the result of new construction units entering the resale market, as early-stage pre-construction investors capitalize on the current boom and cash in after a year or two of renting.

Now, let's shift our focus to the rental market, a topic that's at the forefront of discussions about housing affordability in Canada. We'll provide insights into this segment for those contemplating whether to continue renting or make the leap into homeownership.

First, it's essential to clarify that the statistics we're referring to here are sourced from rentfaster.ca, focusing on asking rents rather than actual leases. However, based on what we’re seeing in the market and property management companies… we can confirm that asking rents align closely with leased rents, lending credibility to the trends we're about to discuss.

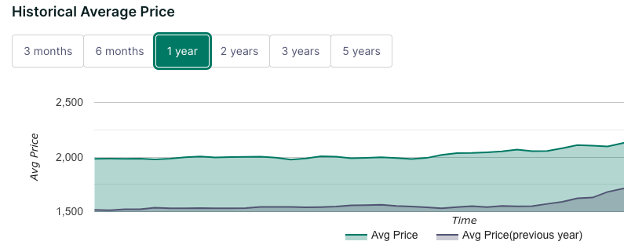

For those considering renting a property in Calgary, the current rates stand at approximately $2,000 for a one-bedroom condo, $2,500 for a two-bedroom unit, and $3,000 for a three-bedroom house. Suited properties, with main floors renting for just under $2,300 a month and basements fetching just over $1,600 per month, have also witnessed significant increases, averaging around $400 more in 2023 compared to the previous year.

Given the upward trajectory of rental rates and housing prices, the question arises: Should you rent or buy if you're planning to move to or currently living in Calgary? Housing affordability has become a national concern, with rising interest rates and seemingly unyielding property prices. So, what do your payments look like if you choose to buy, and how do they stack up against renting the same type of property?

Let's explore the numbers for both scenarios, considering the overall markets for various housing segments, including detached homes, semi-detached properties, row townhouses, and apartment condos. For this analysis, we'll use a 5-year variable interest rate of 5.25% and a 30-year amortization period.

Starting with an 'average' Calgary sale price of $525,000, we'll present two scenarios: one with a 5% down payment and the other with a 20% down payment. A 5% down payment on a $525,000 property amounts to $26,250, resulting in a monthly payment of just over $2,700. With a 20% down payment of $105,000, the monthly payment decreases to $2,300. These numbers are in close proximity to the 'average' rent rate in Calgary, which currently stands at $2,368 per month. While these figures may seem high compared to previous years, it's essential to put them in perspective.

Calgary's property prices remain significantly more affordable than those in Vancouver and Toronto, where average sale prices are more than double what you'd find in Calgary. Rental rates in these cities also surpass those in Calgary. Therefore, when considering the broader Canadian context, Calgary's real estate market offers a relatively favorable landscape.

This is precisely why you should consider diving deeper into our market and learning about real estate investing in Calgary… Don't miss out on this opportunity to unlock the potential wealth and housing options in Calgary's thriving real estate market.

This update is meant for a wide audience, and it can’t reflect every nuance of your particular situation. That's where we come in. I’d love to discuss your housing needs with you, and to give you specific advice that helps you take advantage of Calgary’s current housing climate.

Whatever your situation, whatever your needs, I’m happy to discuss them with you… you can always go to planwithmike.ca to schedule a time for a chat or reach out directly to (403) 809-9386!

Until then, thanks for reading!

COPYRIGHT © 2020. CREATED

BY MIKE ABOU DAHER.