SEPTEMBER 2022 MARKET UPDATE

PULSE OF THE CITY

Summer is over...

but is Calgary's Real Estate run?

Okay, at this point if you have followed our updates over the course of the last 3 months we've been discussing the "shift" that is starting to happen in our market. We've taken the time to express things like:

⦿ Alberta being positioned really well in relation to the rest of our country to weather these interest rate changes.

⦿ How we have just come from the bottom after a long pitiful run in housing prices, so we really can't be added to any conversation to do with "bubble" or "crash" (we have nowhere to crash from!).

⦿ And because of all this, people and profits are moving to our province with no slowdown in sight.

So, this month I'm not going to talk any of that. You know those things - and the news keeps repeating the same messages - so let's move on to what I feel are the most important things I can comment on from our recent set of data.

Today we will talk about Pricing, Payments and Projections.

I could talk to you about the amount of New Sales – it’s basically the same as we had last August and still in line with one of the highest recorded Augusts of all time – but I won’t bore you.

I could talk to you about our Inventory – it’s basically at an all-time low and we are listing even less than we have recently, further keeping it tight – but that story is like a broken record, too, so I won’t.

So, let’s skip all of that and focus on Pricing.

With all the talk about interest rate bumps and possible future increases, the majority of our conversation is centred around the actual benchmark prices and what will happen to them.

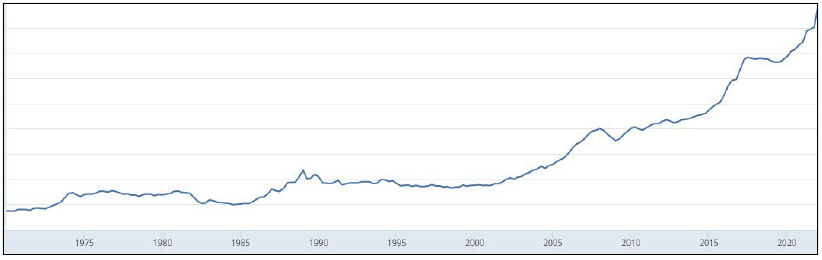

I can tell you one thing first. We have dropped!

I did a little calculation and, as whole, we are down 2.6% from our peak in May –from $546k to $531,800.

So, yeah, across the 2,136 sales in the month of August the price has slid down a wee bit. For further context, this is basically the amount on average we can negotiate off on a given listing price.

So, it’s not a lot at all.

Secondly, in terms of pricing, I did another calculation for you. We remain up 7.4% from January – just 8 months ago – which equates to about $36,500 for the average home. That’s a lot of money. That’s a $4,500 increase per month this year.

And third, our pricing is up 11% from this exact time last year. That’s a whopping $52,800! Or a gain of $150 per day for the entire year. All I can say is “NICE!”

This story continues to be the case across all districts, all price ranges and all surrounding areas to some degree. Year-over-year we are all winning, no matter what real estate we own. If you need information about your specific property type & price range, simply reach out to us as it’s really a hyper specific answer you’ll need to make an executive decision in your life.

"Our pricing is up 11% from this exact time last year. That's a whopping $52,800! Or a gain of $150 per day for the entire year."

Okay that’s enough about pricing for the moment. Let’s now start talking about Payments…

I wanted to talk about this because I want to shed some light on the phrase ‘Don’t wait to buy real estate, buy real estate and wait.’

I’m sure you’ve heard this before.

Well, during our little run up in February through May lots of people focused on the rising sales prices and thought they should sit on the fences and wait, thus ignoring this history-proven truism.

Things like this were said...

“It’s a bubble. The prices will crash. I’ll just wait.” Or “I don’t want to compete on a home, no sense over-paying” and so on…

Let me paint the real world scenario of doing that:

SCENARIO 1. Bought a home at the peak in March to May. Average payment for 5% down would have been about $1,180 bi-weekly.

SCENARIO 2. Bought a home now after prices have ‘crashed’. Average payment for 5% down would now be $1,430 bi-weekly.

What?? Wait!! How could it be more?

Well, it’s no secret that interest rates have risen – in our case about 2%. This rise in rates is far worse for the buyer than the slightly higher price they had to pay.

To make this even more clear, I could have added $100,000 to the average sale price, and the bi-weekly payments would still be less than they are now.

Did we know rates would jump this much? No, but the writing was on the wall.

Did we know prices would basically hold? Yes, we did.

There were absolutely no economic fundamentals in Alberta that would point to a true crash. It was all headline talk and centred on the national picture, not ours.

Back to that quote – ‘Don’t wait to buy real estate, buy right estate and wait’ – lets continue painting that picture...

SCENARIO 1 - Over the 5-year term you’d pay 91k in principal down on your home.

SCENARIO 2 (now) - You’ll pay down 76k in principal. It’s kinda close but it’s still 15% less, or about 15k.

And furthermore...

SCENARIO 1 - Over 5 years you would have paid 62k in interest.

Now, in SCENARIO 2, you will pay 107k. This is a whopping 72% increase, or 45k. Ouch!

I share all this as a present-day, real-world scenario worth paying attention to. It is very rare – and history has proven it time & time again – that it doesn’t pay to buy now, versus waiting. It literally never happens unless you are looking at a very short 1-2 year timeline to enter and exit the market.

"It is very rare - and history has proven it time and time again - that it doesn't pay to buy now, versus waiting."

So, yes, the saying remains true – looking long-term, always buy real estate and wait. Don’t sit on the sidelines hoping for a better time.

Okay, I think you get my point, so let’s finish now with the third P – Projections!

What is going to happen now? I would challenge you, coming off my second point – “Does it really matter?”

If you are interested to own real estate now & into the future, it will remain a positive thing to do.

Who Would Like To WIN Movie Tickets For Two?

Which one of the following does NOT have to do with Honey Bees?

a) Krill, b) Melittology c) The genus Apis d) Royal jelly

Text me at (403)809-9386 or Email me at Team@MikeAbouDaher.com

First 2 correct answers WIN!

But further to that, these are a few things I’m expecting to see:

We will see slight month-over-month price declines from now through to spring. I believe that, as a whole, we could see another 2-5% price easing before we commence with the next spring market.

Now, this will be different for every price point & property type. Most, if not all, will likely be felt in the detached market. As affordability continues to be a driver, more people will look to more affordable options like semi-detached homes, row homes & apartments.

And this is exactly what Augusts’ data shows. The semi & row home market is very tight right now. You won’t see much in the way of deals at all. So much so that the sales-to-new-listing ratio has actually increased this month.

Which simply means that the amount of sales relative to new listings is increasing.

As well, seasonally right now we will see fewer and fewer new properties come to market in the back half of the year. But this is happening while our sales are still near record high numbers.

These two things coupled together will keep condos, rows and semis all in a seller’s market.

The comeback of the condo remains in full swing. Year-over-year sales are up 58% and this trend will likely continue. Watch this market continue to tighten as we proceed to Christmas.

So, I expect our Greater Calgary Market to continue its strength. We have a lot of economic positives going on and we have a supply/demand situation that continues to stoke the fire.

I am also predicting one extra thing...

Regardless of what happens with the September rate hike, or future rate hikes the feds may cook up, the lenders are going to start getting creative.

If there are fewer deals out there for banks to get, they are going to be forced to get competitive with each other and you’ll see products & temporary rate games being played to get your business.

Banks need to lend money in order to make money. So, they will find a way and we will benefit.

And that’s all for this month! If you require any market information relating to your specific situation, please don’t hesitate to reach out!

COPYRIGHT © 2020. CREATED

BY MIKE ABOU DAHER.