New Year, New Outlook for the Calgary Market!

Happy New Year! My monthly updates typically take a close look at how the market performed over the last 30 days or so, with an eye toward how we’re setting up for the month ahead. But December is different…because all Decembers tend to be substantially the same in Calgary’s housing market. So we’ll flip the script this month and spend most of our time looking forward, discussing how the broader economic trends affecting Calgary might play out in its real estate market throughout 2023.

First, though, a quick look at December 2022, just for old time’s sake.

December is always a month for the real estate market to slow down, gather itself, and set itself up for the coming year. Some analysts write it off altogether: a sagging December market is so predictable that it doesn’t tell us much that we can use to make smarter decisions. I prefer to look at each month on its own merits, so let’s have a peek at the numbers.

There hasn’t been much available housing stock on Calgary’s market, and December didn’t do anything to change that. We started the month with roughly 3,100 homes on the market and ended with a record low of around 2,200. Barely more than 1,000 homes hit the market for the first time.

In the midst of this crunch, sales declined to their yearly lows—just as we’ve come to expect from previous Decembers. But here’s where the interesting stuff begins to emerge. Home sales in Greater Calgary fell to just more than 1,200 in December, putting it on equal footing with 2020, 2013, and 2007 as the second-strongest December ever. Last year was the record-setter, and it was an outlier for more reasons than I can count.

So yes: December slumped just as we all expected it would. But it also continued a three-year trend of relatively strong year-end sales, which shines a little light down the line into 2023.

LOOKING AHEAD

If December is always a sleepy month, January tends to leap out of bed without hitting the snooze button. The question isn’t whether things will pick up as we head into 2023: it’s what that bounce-back will look like.

Calgary’s real estate market follows its own yearly patterns, but those patterns are strongly affected by the bigger economic picture. A weak regional economy can dampen the traditional early-year bounce-back; good economic news can amplify it. And the news around Calgary and Alberta is largely good.

THE BIG PICTURE

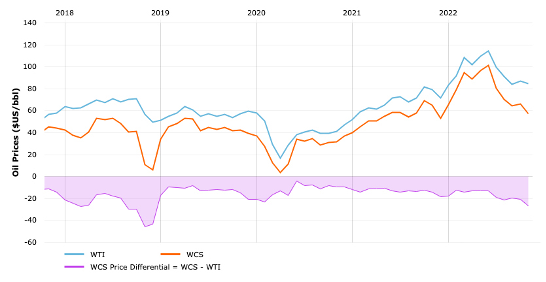

Intermediate) benchmark rose through the first half of 2022. When oil prices fell back to around $80 a barrel, some Albertans began to wonder where they would firm up.

Well, it looks like oil prices have found a good level of support, and at higher prices than a year ago. The growing consensus among analysts is that global oil prices will remain strong throughout 2023, with Brent crude averaging nearly $90. WTI correlates strongly to Brent, and WCS trades at a slight discount to WTI.

Strong oil prices go a long way toward supporting Alberta’s economy, and our unemployment figures bear that out.

Unemployment sits at just 5.8% in Alberta, down two percentage points from last year and remaining significantly below our long-term 6.55% average.

Not everyone in Calgary is directly affected by global oil prices or regional employment rates. Each of us has to keep a roof over our heads and put food on the table, though, and inflation has taken its toll on economic markets around the world.

The Bank of Canada has sought to curb inflation by raising interest rates, and 2022 saw a dizzying seven rate increases, taking the prime lending rate from 0.25% all the way up to 4.25%. Seven might just be a lucky number, because inflation is finally starting to drop, both in Calgary and throughout the country.

Rates will remain at or above 4% for most of 2023. After 2022’s steady climb, that’s good news all in all, and it leaves open a scenario that everyone hopes will come to pass: a reduction of interest rates toward 3% by year’s end, with a target closer to 2% in 2024.

WHAT DOES THIS MEAN FOR CALGARY?

If it strikes you as a bit funny that interest rates have skyrocketed while Calgary’s economy remains largely healthy, you’re not alone. Not that any of us is complaining, exactly, but there’s a downside to being the responsible one in the family.

The most commonly cited measure of inflation in Canada, the Consumer Price Index, is heavily weighted toward housing. Food accounts for 16% of the index’s weight, and transportation 17%, but housing—Shelter, in CPI-speak—is its biggest component, at 30%. That means that nationwide housing trends have a huge influence on the CPI.

Calgary is one of Canada’s steadiest, most resilient real estate markets, but that doesn’t count for as much as it should when housing prices in much larger cities like Toronto and Vancouver find themselves overheating. And that’s just what has happened over the last few years. A frankly ridiculous degree of speculation in Canada’s largest real estate markets has driven housing prices through the roof in our most densely populated areas. That’s how a handful of cities can drive Canada’s CPI to dangerous levels, and it’s why nationwide efforts like interest rate increases hit strong local economies like Calgary’s. We all have to take the medicine, even those of us who aren’t particularly ill.

That’s the major downside these days of being a healthy and sane housing market while others lose their cool. Not that we’re complaining: all told, we’ll happily continue to be a beacon of stability and economic vitality, thanks very much. The fact that interest rates appear to have topped out is fantastic news for Calgary’s real estate market, and it’s just one of the reasons to expect steady growth in the year to come.

OUR REPUTATION PRECEDES US

In light of everything we just covered, it’s natural for Calgary to feel like a younger sibling sometimes. But the world sees us in a much different, much better light.

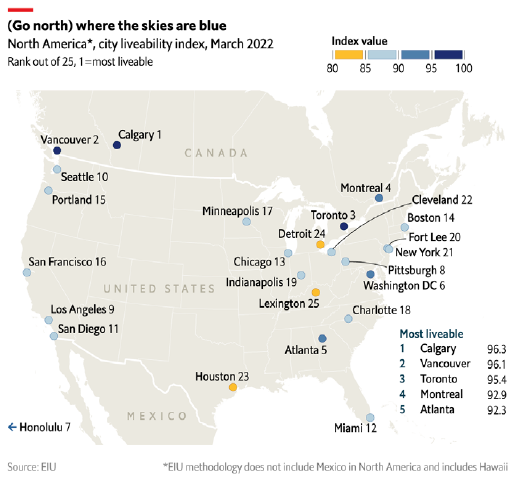

For the third time in ten years, the The Economist ranked Calgary as the very best place to live in North America. This is more than a comparison of housing markets—the study takes in a huge range of indicators, from culture and economic activity to crime and healthcare availability to education and environmental factors.

As it turns out, we’re not Canada’s best-kept secret—or the world’s—any longer. And that’s a good note on which to summarize this peep into 2023.

THE OUTLOOK FOR 2023

With interest rates having crested, oil prices remaining firm, and Calgary’s international reputation at an all-time high, things are looking up for the local real estate market. A historic lack of available housing hasn’t quashed demand, either, which sets us up nicely for 2023—whether you’re looking to sell or to buy.

Analysts predict that prices will remain strong. A study published in Global News predicts a 7% rise in housing prices throughout the Greater Calgary market in 2023, and RE/MAX’s 2023 Housing Market Outlook gets even more specific, projecting an average increase in sale price of almost $50,000.

If anything, I feel that these forecasts might be a bit low, if only due to Calgary’s exposure to nationwide anti-inflation measures. With the Bank of Canada finally making some hopeful statements about interest rates in the year to come, I’m less worried about those factors.

It’s a new year, but some old observations still hold true: Calgary’s real estate market is the safest in Canada, and it continues to reward both sellers and buyers. It may have all the trappings of a seller’s market, and if you’re looking to move on or move up, you can plan to do so with confidence. But the factors supporting increased home valuation in Calgary throughout the coming year are too many and too well-grounded in solid economics to argue against getting into the market if the time is right for you to consider buying a home here. Demand will remain high, builders will remain busy, and the investment you make in early 2023 should deliver a reliable return well into the future.

That’s all for now. I hope this report has given you some food for thought. If you need some help with a specific real estate question, or just want to discuss your options, please write or give me a call. Until then, I’ll chat with you next month.

COPYRIGHT © 2020. CREATED

BY MIKE ABOU DAHER.