The One Factor in Real Estate That’s Worth More Than the House!

Today, we’re diving into Calgary’s real estate scene for this past October 2024 and let me tell you—things are moving in a very interesting direction.

Now imagine a busy marketplace, with people everywhere, browsing for the perfect find. But here, in Calgary’s housing market, everyone seems to be eyeing the same shelves—except those shelves are stacked with high-priced homes, and there’s a lot less inventory in the “bargain” aisles. The demand is alive and kicking, but the story of supply is a bit of a rollercoaster.

So here’s the lay of the land: we have an overall increase in inventory, which is fantastic news! But it’s like finding out half the store is full of premium goods—great if you’re after that, not so great if you’re shopping on a budget. And with a sales-to-new-listings ratio at 67% and a months-of-supply level sitting around 2.3, the market still favors sellers, especially in the lower-price brackets. Buckle up, because we’re about to break down October’s highs, lows, and everything in between.

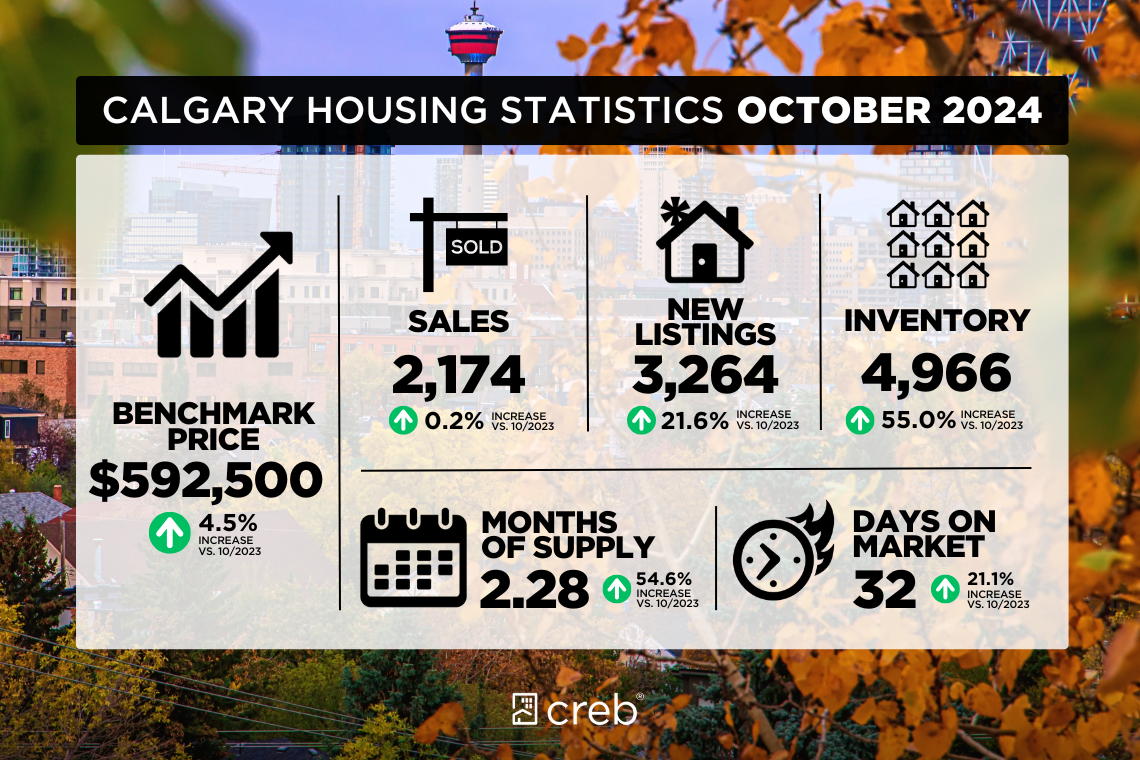

Alright, enough warm-up! Let’s jump into how October performed in numbers, and then we’ll get into some real specifics to see what’s up in Calgary’s ever-shifting real estate landscape.

Market Performance

So, Calgary clocked in 2,174 sales for the month. That’s about the same as last year’s October sales, but here’s where it gets interesting: it’s a solid jump up from September. And not just a little bump, either—these numbers are 24% above Calgary’s long-term average for October. Translation? Demand is still rock-solid, especially if we’re talking about homes over $600,000.

But here’s the twist. While the high-end market is keeping up just fine, the more affordable options are a different story. Sales in the lower price ranges? They’re dropping, and it’s not because people aren’t interested—it’s simply that there just aren’t enough of those properties available.

Now, new listings had a bit of a growth spurt, rising to 3,264. That’s a 22% increase compared to last October, which is definitely helping to ease some of the inventory crunch we’ve been feeling. The higher-end market is really benefiting here, with nearly half of all inventory priced over $600,000. So, if you’re in that range, things are looking up. For everyone else, though? It’s still a bit of a hunt.

So, with these shifts, we’re seeing 4,966 units available citywide, which is 55% more than last October. Yet, if you’re hoping to score a detached home under $700,000, that’s where things are still tight, and price pressures are heating up. Average supply sits at 2.3 months, but it’s more like “speed-shopping” in the lower-price aisles, where supply levels are way below that. In the luxury lanes, though, above $1 million, buyers have a little more breathing room with supply stretching over three months.

Alright, we’re starting to get the picture here. But to really understand how Calgary’s market is playing out, let’s zoom in on what’s happening with different property types—each with its own unique story.

Sector-Specific Analysis

First up, detached homes. October saw a total of 1,071 sales in this category—a solid 10% jump from last year. And, brace yourself, the benchmark price for detached homes hit $753,900. That’s an 8% rise from last October! Even though we’re seeing a tiny seasonal dip from September, it’s nothing to worry about; demand is holding strong. Higher-end inventory is growing, which gives buyers in that range some decent options. But if you’re looking at lower-priced detached homes, it’s still a seller’s market with less than two months of supply.

Next, we’ve got semi-detached homes. This segment is stable, with 190 units sold, marking a 6% bump from last October. New listings here rose by 20%, bringing inventory up to 390 units, which is starting to create some balance, particularly for those on the higher end. The benchmark price? $677,000—a solid 8% up from last year, and holding steady from September. It’s almost like the semi-detached market is saying, “Hey, we’re here, we’re consistent, and we’re a safe bet.”

Row houses tell a slightly different story. Sales were at 353 units, dipping just a bit from last year. But here’s the silver lining: inventory has nearly doubled, jumping to 784 units. So, for row houses, supply is catching up, and we’re seeing a bit of relief from the price pressures that have been building. The benchmark price sits at $456,600, up 8% from last year, with prices leveling off month-over-month. It seems seasonal factors are starting to take effect here.

And last but not least, apartment condominiums. This one’s a bit of a mixed bag. October marked the fifth month in a row of year-over-year sales decline. The culprit? Lower inventory at entry-level price points. Still, the benchmark price has climbed to $341,700, which is an 11% rise from last year. Inventory reached 1,593 units, so there’s some breathing room for higher-end buyers, but affordable options are as elusive as ever. Prices did ease a bit from September, likely thanks to seasonal trends and a fresh wave of new projects in certain areas.

Alright, we’ve covered the property types. Now let’s switch gears and talk about how things are shaping up regionally—because Calgary’s surrounding areas are seeing some interesting trends of their own.

Regional Market Insights

Airdrie is buzzing with activity. Sales are keeping up with new listings, which is helping inventory grow and taking some pressure off buyers. But, here’s the catch: most listings are priced above $600,000. So, while there’s more inventory overall, the entry-level market is still tight. Benchmark prices in Airdrie continue to climb, especially where inventory is thin at the lower price points. It’s a bit like trying to find a reasonably priced gem in a high-end boutique—if you’re shopping below $600,000, be prepared to move fast.

Next up, Cochrane. This area is seeing a delicate dance between new listings and sales, with supply starting to ease up a bit. However, inventory is still limited, and benchmark prices are on an upward trajectory, thanks to a steady demand from buyers, particularly in the lower price ranges. So, if you’re looking for something on the affordable side, Cochrane is feeling a bit of a seller’s advantage, even as higher-priced options become more available.

And then there’s Okotoks, which has its own story to tell. Sales here are on the rise, but new listings haven’t quite kept up with demand, especially in the lower-priced homes. This has led to some pretty intense competition, keeping upward pressure on prices. The limited availability in the lower and mid-price segments means that sellers are really benefiting from strong demand. All signs suggest that this competitive dynamic will hang around for a while, especially as more buyers eye Okotoks for its appealing mix of amenities and proximity to Calgary.

So, Calgary’s neighbors are feeling the ripple effects of its hot market, each in their own way. Now, with the regional scene in focus, let’s talk about what’s on the horizon as we head toward the year’s end.

Forecast

If October is any indicator, strong demand is here to stay, especially in those higher-priced segments. We’re likely to see sales continue at a steady pace, driven by inventory increases at the top end of the market. So, if you’re eyeing homes above $600,000, there’s a good chance you’ll have more choices as listings rise, and the playing field becomes a bit more balanced.

In the more affordable segments, though, it’s a different story. The supply of budget-friendly options is still stretched thin, which could put a cap on sales growth. Unless we see a significant surge in new listings at lower price points, these properties will stay in high demand and relatively short supply, keeping competition fierce.

As for prices, benchmark values are expected to stay on the high side across all segments, with maybe a slight seasonal adjustment as we move into the winter months. Detached and semi-detached homes are especially likely to see a lift in new listings, as sellers respond to the sustained price momentum. But overall, the lower-priced segments will probably stay hot, meaning prices may not budge much there.

Now, let’s talk about the broader economic influences at play. Calgary’s stable job market, coupled with interest from out-of-province buyers, is fueling demand. And we’re seeing a bit of a shift in buyer composition, with a tilt toward those higher-end properties, where supply is more balanced. On the flip side, unless there’s a surge in listings, affordable homes will continue to be snapped up quickly, tightening conditions in those segments.

Finally, what does this mean for buyers and sellers? For first-time buyers, it’s still a challenging market, especially under the $600,000 range. But for seasoned buyers and investors, the high-end segment is offering more opportunities. Sellers in the lower price brackets have the upper hand, while buyers on the higher end will likely find better-negotiated deals thanks to the increased inventory.

Alright, we’re almost at the end, but before we wrap up, let’s bring everything together with a few key takeaways.

If you’re a seller, especially in the lower to mid-price ranges, it’s a great time to list. Demand is outpacing supply, and the competition is heating up, meaning you’ll have a solid pool of buyers to choose from. For buyers, particularly in the higher price brackets, the improving inventory might work in your favor. With more options on the table, you could find that rare sweet spot where you can negotiate a little and find a property that checks all the boxes.

Looking at the long-term picture, Calgary’s market is staying vibrant and resilient, with strong economic fundamentals and steady demand. Seasonal shifts might nudge prices slightly, but the outlook is bright for anyone looking to invest or settle down in Calgary.

Alright, so we’ve got the big picture of Calgary’s market and as you dive into the numbers, you might wonder: where’s the hidden opportunity? Sometimes, what makes a property a gem isn’t obvious at first glance, especially when prices are soaring and competition is fierce.

Which brings me to a tip that can help you find value in places others might overlook…

Understand the Land-to-Building Value Ratio

For detached homes, especially those charming older ones, a great tip is to look at the land-to-building value ratio. Here’s why: in certain neighborhoods, especially where development is buzzing, the land itself may be worth more than the building sitting on it. This happens because while the home might lose value over time (yep, that roof ages!), the land beneath it keeps appreciating, particularly in high-demand areas.

So, if you’re weighing a few options, take a closer look at the property value breakdown. Properties with a higher land-to-building ratio could be a savvy long-term investment—even if the home might need a little TLC. Essentially, think of it as buying the future potential of the land rather than just the house on top. The returns might just surprise you as the area grows.

So, now that we’ve got the tip on land value in mind, you might be wondering how to spot this kind of hidden potential in everyday real estate. Sometimes, to see the opportunity, you have to think like a business that’s all about location and long-term vision—like one company that built an empire on a surprisingly similar approach. And believe it or not, it’s a company you probably pass by every day.

Ever wondered why McDonald’s is practically on every street corner? Spoiler alert: it’s not just about the fries. When Ray Kroc took over McDonald’s in the 1950s, he wasn’t just flipping burgers; he was cooking up a real estate empire. Here’s the twist: Kroc figured out that owning the land was way more valuable than just selling burgers and shakes.

Here’s how it played out. Kroc knew that every new franchise needed land, so instead of leaving location decisions up to franchisees, he created the Franchise Realty Corporation. This company would buy up high-traffic land and lease it to McDonald’s franchisees. Not only did this give McDonald’s control over prime real estate, but it also meant the company was pocketing monthly rent payments while the franchisees dealt with the day-to-day burger hustle. For Kroc, it was like getting paid twice.

This strategy turned McDonald’s into one of the world’s biggest real estate owners. Today, McDonald’s isn’t just the “fast-food giant”; it’s a top player in the real estate game, with prime locations worldwide. And here’s the kicker: McDonald’s real estate often holds more value than the entire fast-food business itself. In fact, more than 85% of McDonald's property is owned, not rented, so every time you see those golden arches, you’re looking at a serious investment in some of the world’s most valuable land.

Kroc’s land-first focus paid off because he recognized an underlying truth: locations that draw crowds only grow in value, even if the buildings get worn out. It’s a reminder that sometimes the real treasure isn’t what’s on top; it’s what’s underneath.

Just like Ray Kroc saw the hidden gold in McDonald's land, knowing how much of a property’s value lies in the land versus the building can change the game for homebuyers. When you’re assessing a home, especially in growing areas, look beyond the walls and check out the land value. Sometimes, as in McDonald's case, the real investment isn’t the building itself—it’s the land underneath, quietly appreciating and setting you up for a solid long-term gain, even if the house needs a little love.

It’s amazing how a shift in perspective can uncover opportunities that others miss, isn’t it? Just like Kroc saw value in real estate beyond his burgers, finding that hidden potential in Calgary’s housing market is all about understanding the details that make a difference. Whether it's land value, timing, or picking the right type of property for your goals, having someone in your corner who knows the ins and outs can make all the difference.

If you’re looking for that kind of guidance, I’d be happy to help you see the market through a sharper lens and help turn your real estate goals into real wins.

So, here’s where you come in. If you’re thinking about buying, selling, or even just dipping your toes into the Calgary real estate market, there’s no better time to get personalized insights tailored to your unique situation. Whether you’re a first-time buyer looking for the best deal in a competitive price range, a seller ready to take advantage of today’s high demand, or an investor aiming to make smart moves, I’m here to help.

Head over to PlanWithMike.ca to schedule a one-on-one consultation, or reach out directly at (403) 809-9386. Let’s turn your real estate goals into reality and make the most of Calgary’s market together.

Thanks for tuning in, and don’t forget to subscribe to stay updated on everything real estate. Until next time, take care and happy house hunting!

To seeing the land of opportunity!

COPYRIGHT © 2020. CREATED

BY MIKE ABOU DAHER.