Like Yogi Berra once said, 'It ain’t over till it’s over.'

If you’ve been waiting for the perfect time to sell, you might be missing the best opportunity!

The Calgary real estate market in August 2024 showed clear signs of moving away from the extreme seller’s market we experienced earlier this year. While demand continues to be strong, the rising supply, supported by new home construction and gains in new listings, has begun to ease some of the pressure. For the first time since late 2022, the months of supply have exceeded two months, signaling a shift toward a more balanced market.

The key trend we're observing is a divergence in activity across price points. While higher-priced homes are contributing to the inventory increase, affordable housing remains in short supply, leaving buyers in this segment still facing challenges. These market dynamics are setting the stage for the current and upcoming months as we continue to see evolving buyer and seller behaviors.

In this report, we'll take a deeper dive into the August statistics, analyze sector-specific performance, and discuss the regional market insights for Calgary and its surrounding areas.

Let’s explore the data and trends that shaped August 2024.

Market Performance

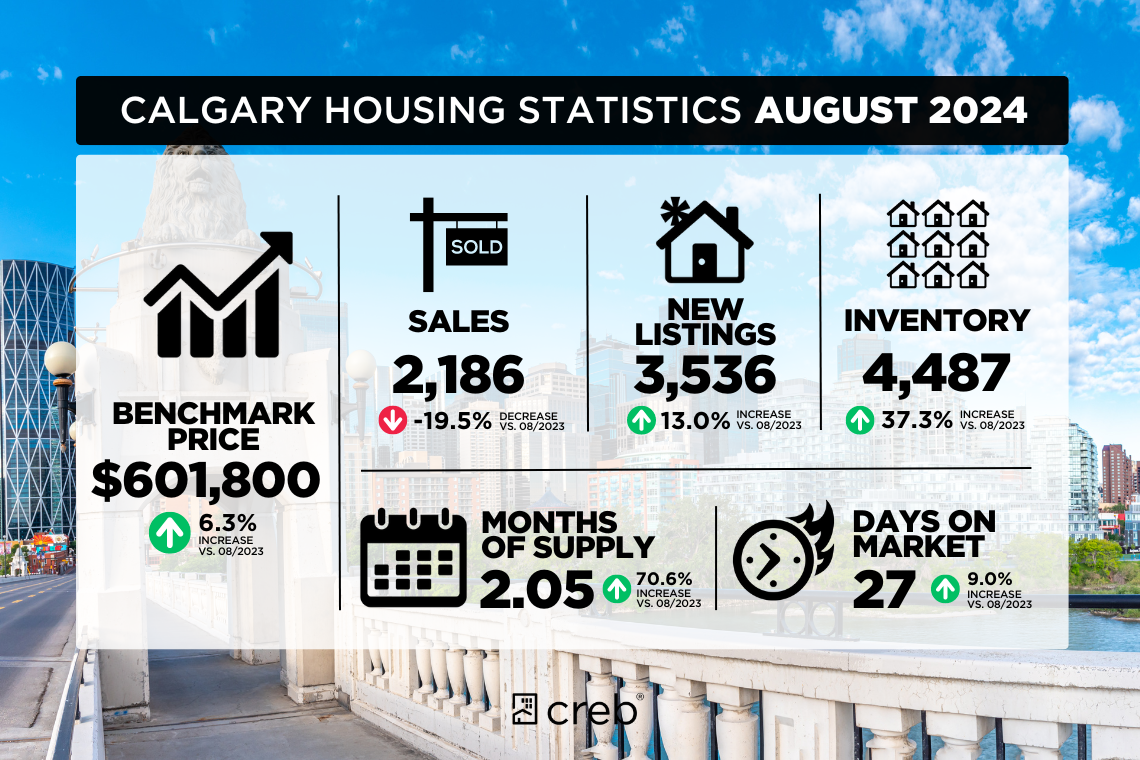

The Calgary housing market this August experienced significant changes compared to the same period last year. Total sales for the month reached 2,186 units, reflecting a 19.5% decline year-over-year. This drop in sales is largely attributed to the reduced activity in homes priced below $600,000, which are still facing inventory shortages. However, despite the decline, sales remain 17% higher than the long-term averages for August, indicating sustained demand in the market.

New Listings and Inventory

In August, the market saw 3,536 new listings, a 13% increase from the previous year. This influx of new listings helped to boost inventory levels, which rose to 4,487 units—37% higher than August 2023. However, it’s worth noting that overall inventory remains nearly 25% lower than the long-term trends for this month, particularly in the lower price segments. Most of the inventory gains came from higher-priced properties, while more affordable homes continued to experience declines.

Benchmark Price

The benchmark price for total residential properties was $601,800, marking a 6% year-over-year increase. However, this price is slightly lower than the previous month, suggesting that the rapid price growth seen earlier in the year is beginning to cool down as market conditions shift. Year-to-date, the average benchmark price has risen by 9%, demonstrating the resilience of the Calgary market amid fluctuating conditions.

Implications for Buyers and Sellers

With the easing of sales and gains in supply, the months of supply have now surpassed two months—a level not seen since the end of 2022. This is a crucial indicator that the market is shifting toward a more balanced state, though it still remains slightly tilted in favor of sellers, particularly for lower-priced properties. Buyers in the higher-end market are now seeing more options, while sellers, especially those in the lower price ranges, continue to benefit from tight conditions.

Sector-Specific Analysis

In August 2024, Calgary’s real estate market demonstrated varied performance across different property types. Here’s a breakdown of the activity in detached homes, semi-detached homes, row houses, and apartment condominiums:

Detached Homes

Detached homes remain the most sought-after property type, though sales were down 14% compared to last year. The sales decline is attributed to lower availability of homes priced below $600,000, as inventory in this segment continues to struggle. However, homes priced above $600,000 saw some gains, and this has helped boost inventory levels to 2,011 units, marking a significant improvement over the spring when inventory levels were critically low. As a result, the months of supply for detached homes has increased to nearly two months. The benchmark price for detached homes in August was $762,600, slightly lower than the previous month but still 9% higher year-over-year.

Semi-Detached Homes

The semi-detached market showed signs of balancing in August, with 297 new listings and 172 sales. The sales-to-new-listings ratio dropped to 58%, consistent with pre-pandemic levels, leading to a slight rise in inventory. The months of supply for semi-detached homes climbed to nearly two months, easing some of the pressure on prices. In August, the unadjusted benchmark price was $681,200, a slight decline from the previous month, but still 10% higher than last year.

Row Houses

Row houses saw a notable increase in new listings, particularly for homes priced above $400,000, contributing to year-to-date growth of nearly 16%. Sales in this segment have slowed over the past three months, which has resulted in inventory gains. By August, there were 660 row houses available—a 75% increase from the historically low levels of last year. Despite the increased supply, inventory levels are still relatively low by historical standards. The unadjusted benchmark price for row houses in August was $461,700, which is slightly down from the previous month but still 12% higher than the same time last year.

Apartment Condominiums

The apartment condominium market in August was characterized by record-high new listings, reaching 1,001 units. While this marked a significant increase, sales declined by 31%, resulting in a sales-to-new-listings ratio of 60%. Inventory levels rose to 1,476 units, which is more consistent with long-term trends for this property type. The increased supply has led to some softening in the market, with months of supply rising to 2.5 months. Despite this, the unadjusted benchmark price for apartment condos remained stable at $346,500, representing a 16% year-over-year increase.

Regional Market Insights

The Calgary real estate market is dynamic not only within the city itself but also in surrounding areas like Airdrie, Cochrane, and Okotoks. Let’s explore how these regional markets performed in August 2024:

Airdrie

In Airdrie, the market saw a continued rise in new listings compared to the previous year. With 242 new listings and 172 sales, the sales-to-new-listings ratio remained relatively high at 71%. While this ratio reflects the tight conditions in the market, it also prevented a more significant gain in inventory, keeping the months of supply below two months. The tightest market conditions persist in the lower price ranges for each property type, creating pressure on buyers. In August, the unadjusted benchmark price for Airdrie was $553,300, nearly 8% higher than the same time last year, showing the strength of this suburban market despite the slight cooling in demand.

Cochrane

Cochrane’s market maintained strong seller conditions in August. There were 81 sales and 109 new listings, keeping the sales-to-new-listings ratio at a high 74%. Inventory levels remained tight, with 144 units available—42% lower than the long-term trends for this time of year. The continued scarcity of inventory has driven further price growth, with the unadjusted benchmark price rising to $578,600. This marks an 8% year-over-year increase, with the largest price gains occurring in the apartment-style property segment.

Okotoks

August was a solid month for the Okotoks real estate market, particularly in the detached home segment, which saw a boost in sales. The 67 sales in August were matched by 84 new listings, bringing the sales-to-new-listings ratio to around 80%. Despite the increase in listings, inventory levels in Okotoks remain nearly 47% lower than long-term averages, resulting in ongoing tight market conditions. The unadjusted benchmark price in Okotoks for August 2024 was $622,700, a 7% increase from last year, reflecting the continued demand in this family-friendly community.

Looking ahead to the remainder of 2024, several trends and market shifts are expected to shape Calgary’s real estate landscape.

Sales, Listings, and Prices

As new home construction continues to rise and new listings increase, we anticipate further improvements in the overall supply of homes, gradually bringing the market closer to more balanced conditions. However, it’s important to note that while inventory gains are expected, particularly in the higher-priced segments, the availability of lower-priced homes will likely remain constrained.

We expect sales activity to stabilize following the sharp declines in the first half of the year, particularly in homes priced below $600,000. This price segment remains in high demand, and without significant inventory growth, buyers may continue to face competitive market conditions. On the pricing front, the pace of price growth is expected to slow further. With the months of supply now above two months, the rapid price gains seen earlier in the year are likely to moderate, especially in detached and semi-detached home segments.

Market Shifts and Economic Factors

A recent drop in interest rates is expected to boost buyer activity, particularly for first-time homebuyers and those looking to lock in favorable financing conditions. Lower borrowing costs could lead to renewed demand in both the affordable and mid-range market segments, potentially offsetting some of the inventory constraints. Additionally, Calgary’s economic strength, driven by industries such as energy, may continue to provide a stable backdrop for the housing market, keeping buyer sentiment positive.

Impact on Market Segments

For first-time buyers, the recent drop in interest rates may provide an opportunity to enter the market, though limited inventory in the lower price ranges could still pose a challenge. Expanding their search to areas like Airdrie and Cochrane could help overcome some of these hurdles. Meanwhile, seasoned investors and high-net-worth buyers may continue to find opportunities in the higher-end market, where increased inventory could lead to more negotiation flexibility and competitive terms.

The August 2024 Calgary real estate market showed signs of shifting away from the extreme seller’s market conditions that defined the first half of the year. Rising inventory levels, particularly in higher-priced segments, and a modest pullback in sales are leading the market toward more balanced conditions. However, demand for affordable housing remains strong, and supply in this segment continues to lag behind, maintaining tight conditions for buyers.

The benchmark price for residential properties continues to grow, though at a slower pace compared to earlier in the year. With the recent drop in interest rates, we expect to see renewed activity, especially among first-time buyers looking to capitalize on favorable borrowing conditions. Yet, challenges persist due to limited inventory in key price segments.

For buyers, particularly those in the lower-price ranges, acting quickly and staying informed about new listings will remain crucial in this competitive environment. Sellers, meanwhile, can still expect favorable market conditions, particularly if they are listing in the higher-end price brackets where inventory has improved.

Overall, the Calgary market remains resilient, supported by economic strength and sustained demand across various buyer segments.

Whether you’re a first-time buyer, seasoned investor, or looking to sell, let’s create a strategy tailored to your needs. Contact me today at (403) 809-9386 or visit PlanWithMike.ca to schedule a time to chat. Let’s turn your real estate goals into reality!

COPYRIGHT © 2020. CREATED

BY MIKE ABOU DAHER.